Wealth Creation the fun way

Make money now with Classic Cars.

Some cars such as the Ferrari 250 GTO have gone from US$18,000 when new to US$51.7 Million in a sale last November. Only 39 were ever built.

Why purchase new cars when they DROP in value immediately, and all look the same ?.

ALL cars that we select RISE in value rapidly, are stunningly individual and more reliable.

Welcome to 2024's fastest rising asset class.

Just like some shares and property used to do, certain assets in this category gain significant value when you know exactly which ones to purchase before they rise.

We use 30 years of specialist knowledge to ONLY acquire the specific cars that are about to explode in value.

CALL NOW if you want to start small, and then go on to make serious money while having fun.

All the cars listed below have now hit the News, and so their growth is over. That is when the public starts purchasing these cars, and we stop acquiring them.

We move on to the next 62 growth cars, many months ahead of the market.

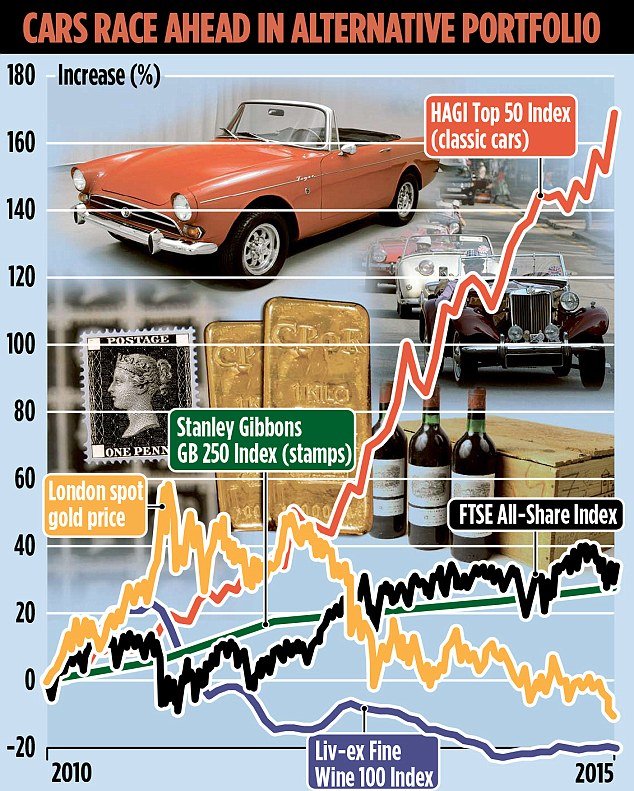

Latest Old News about Collectible Cars from the World's Financial Experts

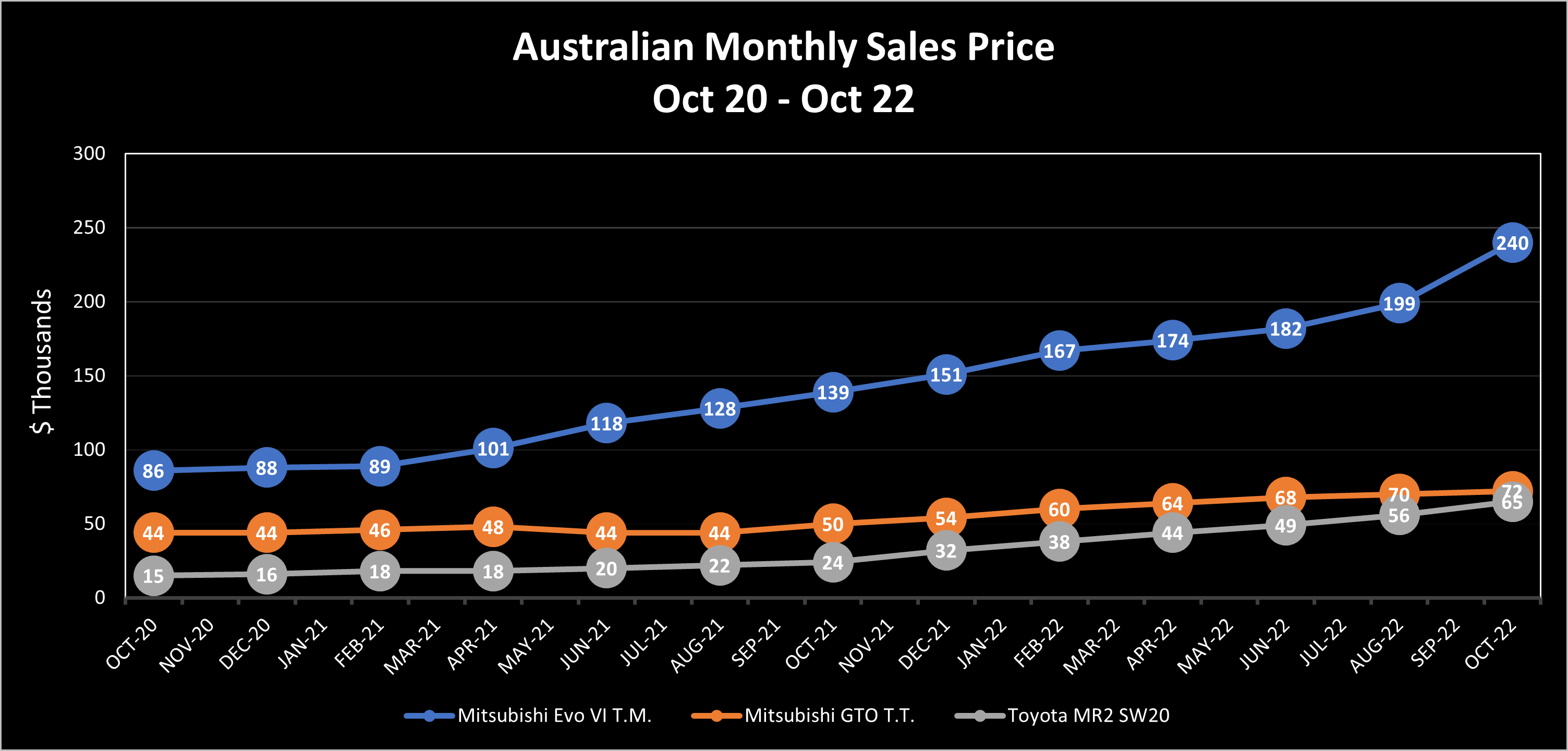

The trend for Classic car Sales in Australia

|

|

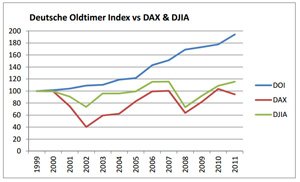

The cars shown above have had their run, and are now at the TOP END of their growth. We are now purchasing many of the next 62 cars that will double, and possibly triple in value. Call us on 1800 001017 Australia now has it's turn at an industry that has quadrupled in size in the U.K over the last 6 years. Just read our News Articles to find out more, which are all written by the world's leading Financial Authorities. There are now 62 Collectible Cars for Sale that will gain at least 38% in value over the next 12 months, with 7 more that will see even greater value gains across 2024 and 2025. Please note that we are NOT part of the Classic Car Market, as our cars are ONLY purchased for Capital Growth directly from a plethora of Collectors in the U.K., the U.S.A., and Australia. Each car has to be precisely the correct make and model, with total originality throughout. We are only EVER working with a maximum of 3-4% of the total Modern and Classic Car Market, or less. Our area of interest is VERY specific, and there is no information available anywhere elsewhere that explains what we do. This was the Global outlook for Classic/Collectible Cars until 2015, and the trend has just continued unabated :

This Graph is courtesy of "This is Money", the financial website of the year. The boom for Classic Car Sales in AustraliaThe boom is on. All of our cars sell ''off-market'', with NO advertising, to astute Private Car Collectors that we are connected with, except a handful that we personally retain for our own future prosperity. Generally speaking, these Collectors have tripled their money across all of their Collectible, Classic and Unique Cars in the last 2-3 years. Real Estate does not even get close, as some of their cars are worth US$20-40 Million. Almost everyone serious about making money in Europe and the United States has been riding the boom in Collectible Cars for many years now, and now the boom has arrived in Australia. All across Europe, there are endless television shows, magazines and newspapers that come out every week full of Collectible Cars to purchase, and every mainstream publication in Britain runs features on these cars. This boom is now so prolific in Europe that even Britain's Financial Times runs Seminar's on Classic Car Investing, due to the fact that Classic and Collectible Cars have been rising in value continuously for the last 20 years, making them very safe territory. The Knight Frank Luxury Investment Index shows us that Classic and Collectible Cars have now yielded over 476% returns over the last 10 years. Whilst this is general knowledge amongst Collectible Car lovers to others, it is still new. The boom in Australia is still in its infancy, and so the opportunities are sizeable. We make the process of getting involved very simple : 1) Call us and introduce yourself to us. 2) Tell us which of the 62 Collectible Cars that you would like to be involved with. 3) Tell us if you would like to become involved in full time, or part-time. 4) Come and join us in a very lucrative vocation that is loads of fun, and is the new Asset Class for Investors. The growth in Global Classic Car prices

Purchase a Collectible CarJust as with property and shares, there are makes and models to acquire, and those to avoid like the plague (Covid ?). There can be one manufacturer with 2 models built on the same day in the same factory, and yet one will rise astronomically, and one will remain stable, or fall in value. Have your Collectible Car restored by usRestoring your current Collectible Car to the way that it was when it was new. It is one of two ways to reach the absolute pinnacle of your return on investment, as there are 3 different conditions that unique cars are sold as, and taking your car up one grade will net large returns. You can view our Classic Car Investment options. Get yourself into the Collectible Car businessAt Supercar Secrets we move vehicles around from country to country, as they are quite often worth considerably more in one country than another. You can have your unique car, or classic car shipped to Australia, use it for a year or two, and then ship it back to Europe or The United States. Join us in our Classic Car Business articles.

|